Learn personal finance English collocations. To keep afloat. To spend a fortune. To cut down on luxuries.

Listen to Speak Better English with Harry podcast episode on all major apps. Scroll down to read the transcript.

Speak better English with Harry - Episode 311

Harry

Personal Finance English Collocations

personal finance English collocations

Share and help other students to improve English language skills.

Hi there, this is Harry. Welcome back to my podcast where I try to help you to get a better understanding of English so that you can communicate in a way that you feel comfortable with. Either in conversational English or business English. With your friends on holidays, whatever that might be.

We help you with pronunciation, grammar, and of course, idiomatic expressions, phrasal verbs, whatever it takes, we’re there to help you.

Okay, so what are we going to look at in the podcast today? We’re going to talk about finance. And then indeed, we’re going to talk about personal finance that we’re going to focus on personal finance English collocations. So quite a mouthful, personal finance English collocations. So what does that mean? Well, it means words connected with personal finance and money talks. Yeah, that’s what we have an expression, we use in English ‘money talks.’

And of course, people like to talk about money as well. Yeah. Okay. So we’re going to use some expressions that you might hear if you’re talking or listening or reading about personal financial matters. So as always, I’m going to go through these ones one by one. Then I’ll give you some examples. And at the end of this particular podcast, I’ll give you my contact details.

Intermediate to Advanced English Marathon

INSANITY: doing the same thing over and over again and expecting different results.

Albert Einstein

- What you'll learn:

- better understanding of more complex grammar structures

- advanced English vocabulary words

- British & American slang

- perfect your listening skills through practing different accents

- This marathon is for you if you're:

- stuck at an intermediate English level

- tired of confusing explanations

- a mature student

- shy & introverted

Okay, so let’s start first one

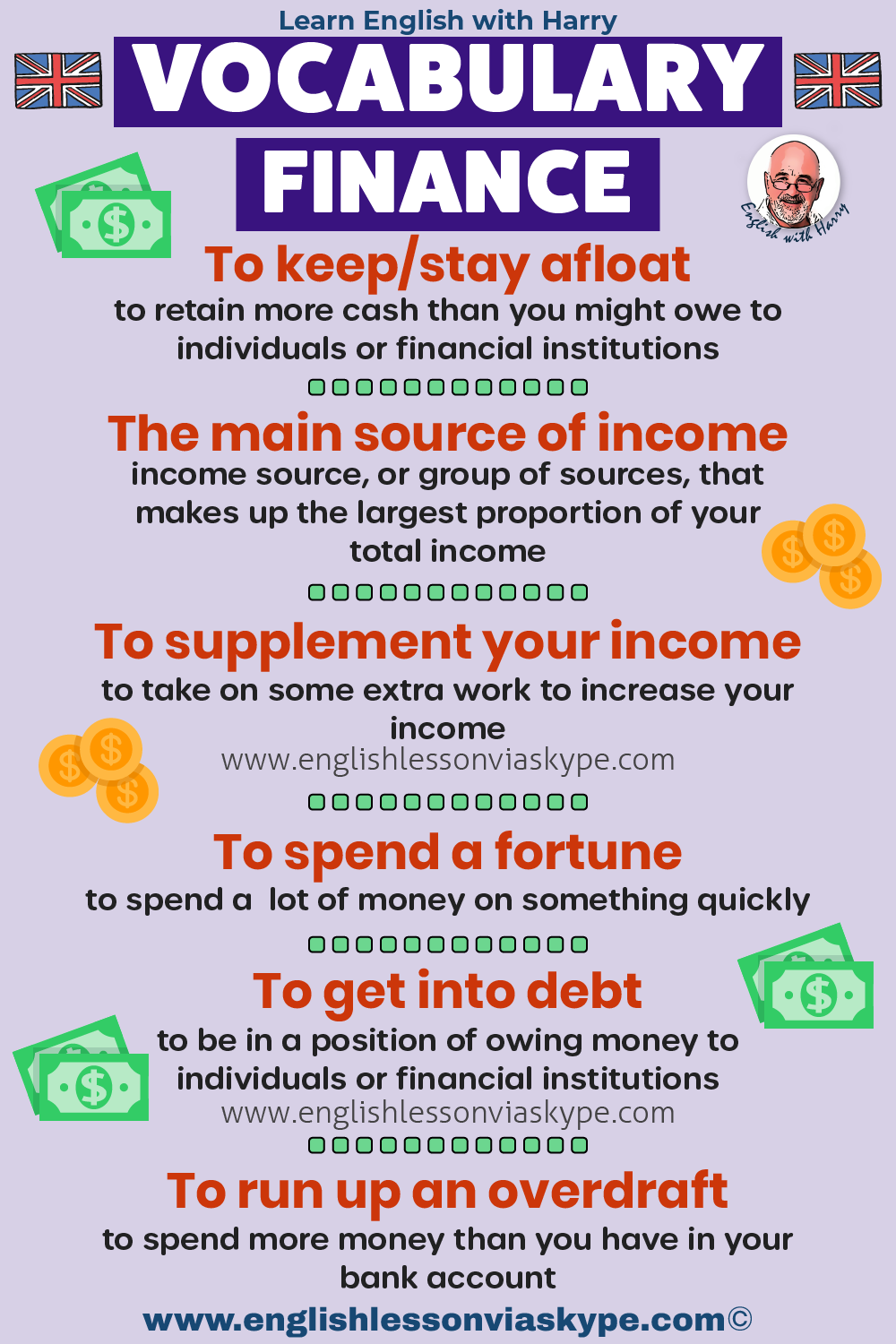

- to keep afloat, or stay afloat

- the main source of income

- to supplement your income

- to get into debt

- to spend a fortune

- to run up an overdraft

- to cut down on luxuries

- to clear your debt

- to pay back the loan

- to write off the debt

Okay, so all connected with personal finance.

As you’ll have heard, quite a number of those use the word ‘debt.’ Debt is spelt D-E-B-T, and the B is always silent. So it’s pronounced as if it was spelt D-E-T. ‘Debt’ is something you owe somebody else. When we’re talking about personal finance, you want to stay away from debt. You don’t want to get into debt because it’s a slippery slope, as they say, somewhere where you’re going to end up in difficulty.

Okay, so personal finance, interesting, but you just have to be very, very careful. So let’s go through them. And let’s explain these particular collocations.

So the first one

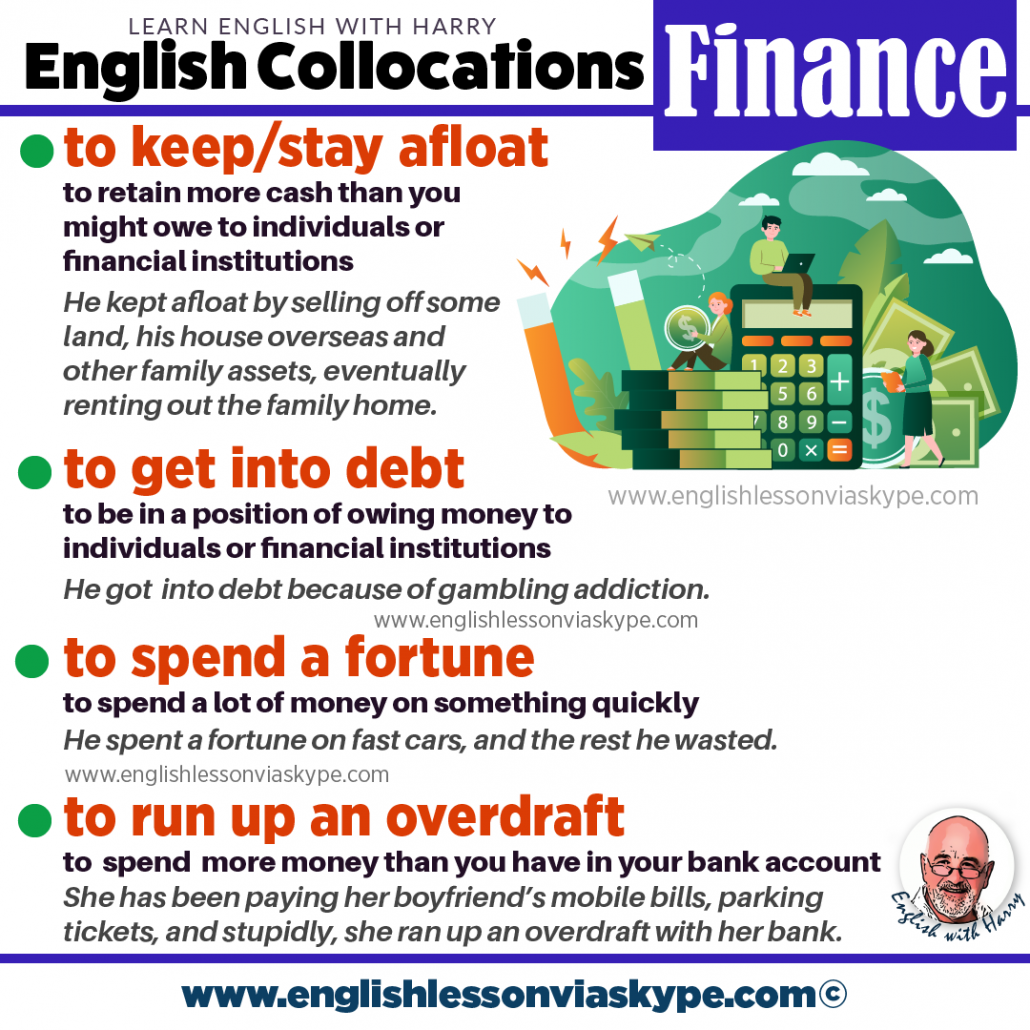

to keep/stay afloat

When we talk about afloat, it means to float on water. Okay, so you know how difficult it is to stay afloat. If you jump into a pool, you’ll sink unless you know how to float properly. A little bit easier in salty water, because there’s a natural buoyancy that keeps you afloat.

So when we’re talking about personal finance, to keep afloat means to keep your head above water, to keep yourself in money or in credit, so that you don’t owe anybody any money. Or if you do, or somebody some money, you’ve got cash, which is greater than the amount that you owe. So to keep afloat means to keep yourself on the right side of your personal finances, that you’ve got more money coming in than going out. You retain more cash in your business than the money you might owe to individuals or banks, other financial institutions.

He was able to stay afloat because his parents lent him some money.

He was able to keep afloat because he had a very good business, head on his shoulders, and was able to know when to do a deal and when not to do a deal.

So he didn’t get, as we say, in English, out of his depth.

Not debt, out of his depth. Ah, you know, again, another reference to water. If you get out of your depth, you’re in very deep water and if you can’t swim, you’ve got a problem.

In business or in personal finance, if you get out of your depth, then there’s a good chance that you will not keep afloat.

So to keep afloat is to keep yourself in financial positive territory.

To stay afloat means the same thing, to make sure your business and you are successful.

Okay, next,

the main source of income

Income is the money that comes in. If you’re working for somebody, it’s your salary or your wages. If you work for yourself, it’s the income you generate from whatever activities you have. If it’s a business, it’s the money you get from selling your products into the marketplace.

So the main source income is the main income that you receive. You could get income from many different sources.

So for example, if you’re working for a company, and they pay a salary because you’re working there, Monday to Friday, then that’s likely to be your main source of income, even if you make a little bit more income yourself at the weekends on a Saturday or Sunday, but relative to the rest of the income you get, it’s not so great. So, therefore, your main source of income is the salary that you receive.

As for a company, its main source of income is likely to be the income it gets from selling its products into the retail market, or to other distributors. The main source of income.

personal finance English collocations

Share and help other students to improve English language skills.

to supplement your income

Well, that, of course, can be something different. To supplement something means to add, or to support, or to increase, okay.

So if you want to supplement your income, then you might take on some extra work. So, you know, you might find yourself in a situation that you have to pay for a new baby that’s coming along because of extra costs, and to supplement your income, you take another job, at the weekends.

I did that when I was newly married many, many, many, many years ago. I was working for a financial institution, and the salary wasn’t so good. And I worked in a bar at the weekends, I wasn’t supposed to because of the way the bank operated, but I worked on a Friday night or Saturday to get some extra income, some additional income to supplement the income that I got from the bank.

So when you want to supplement your income, you do something else to give you some support, to give you some comfort. So you will be doing that to keep afloat or keep your head above water.

Okay, so the first mention of debt is in the next one

to get into debt

Well, during our lifetime, we all get into debt at some stage. It might be small, it might be medium, or it might be very big. Okay, hopefully, for most of you, it’s small or medium, and you can control it.

We get into debt when we buy our first house or apartment. Why? Because we don’t have the money to buy it out, right? Unless we’re really, really lucky. So we go to the bank, and we get credit, or what we call in English, a mortgage debt. And when you have a mortgage, you get into debt, okay. It’s controlled, because there’s a limit as to the amount that they will give you. But nonetheless, it is still debt, and it still has to be repaid. Okay.

So now when we say to get into debt, usually it means we get into it unknowingly, or by accident, okay.

So we might do something a little stupid, we buy more supplies than we actually need. We can’t sell the products that we make, and therefore we have to borrow more money from the bank. And as a result, we get into debt, and then we struggle, okay.

We might get into debt because of gambling addiction.

People start gambling, and they use money that they don’t have. And, you know, that is another slippery slope, that’s something that’s going to drag you down into a bigger problem.

So we can get into debt in many, many different ways.

If it’s controlled, then it’s okay.

For a company to develop, you have to have some debt. You need money to buy machinery, you need money to rent premises, you need money to develop your product, so you have to get into debt. But if you have a good business plan, well, then you can manage your way through that.

book your trial English Lesson

Next

to spend a fortune

Ah, yes, the joys and wishes of a lot of people who wish they had a fortune so they could actually spend it. And, and to spend it wisely.

So a fortune is usually a mass of money, you know. You might inherit a fortune from an old aunt or grandmother or parents. When you inherit that money, you might be a little bit unwise, and you might spend it very quickly on fast cars.

This is the old story for those of you who remember the great, great footballer George Best. He made a lot of money as the best footballer the world had seen at the time. And when he was being interviewed, they asked him, what did he do with his money.

He said, ‘Well, most of my money, I spent it on fast cars and fast women, and the rest of it I wasted.’

So to spend a fortune means to spend money, that you’ve inherited money, you’ve earned money you’ve been given, fortuitously, locally or whatever way. To spend a fortune means to go through the money quite quickly until there’s none left.

to run up an overdraft

An overdraft is quite an old fashioned expression in banking. Nowadays, an overdraft is usually the money you borrow from the bank for a short period of time, usually a few months or six months, but generally in accounting terms less than 12 months, okay?

An overdraft is a credit the bank gives you because you’re expecting to get money in the short term. So if you don’t have money in your bank account at the moment, and you want to go on a holiday, or you want to buy a car, the bank may allow you to go and draw money or use money that you don’t have. There’s a good chance and an expectation that you’ll receive money in a short period of time. So you get or you’re granted or you run up an overdraft.

And to run up something means you start using the bank’s money a little bit. Now a little bit tomorrow, a little bit next week. And bit by bit you run up to it when it becomes a bit of a difficulty. So to run up means it adds up to quite a lot. So it starts off small, you add another bit.

And then when you look at it, after three or four weeks, you’ve got a problem, you have run up an overdraft. Okay, so that has to be repaid to the bank.

So to run up means to build up from small add, add, add, and then at the end of a period of time, you’ve got something quite large, and that can cause you some problems.

personal finance English collocations

to cut down on luxuries

Well, if we do have financial difficulties, if we do run into problems with our bank, if we have run up an overdraft, then something has to stop. And the bank may ask us to sell the car, they may ask us to stop spending money on our credit card, they may withdraw the credit card or they may reduce the limit. Either way, what’s going to happen is we will have to cut down on luxuries.

To cut down on something means to reduce.

So if your luxuries were eating out two or three times a week, you may cut it down to once.

If your luxuries were going on three family holidays a year, you may cut those down to one.

So to cut down is to reduce. Not to stop entirely, that will be to cut out.

To cut down on luxuries – to reduce the spending so that you can make your finances more manageable and these overdrafts and other debts that you have can eventually be controlled and repaid. So to cut down on luxuries.

to clear debt

Yes, you can sit back and you can breathe easy when you get a letter from the bank thanking you for paying off the last of the loan. And you’re now clear. And as we would say in English, you are back in the black meaning when you look at your statement, there are black numbers, not red letters and red numbers.

So to clear your debt is to pay back what you owe to other people.

So you go into the bank, you make a deposit or you transfer money online to clear the debt that you have. And you can breathe easily because that contract came through, the client came through and you got your money. So you clear your debt.

And you can clear your debt to your parents that they helped you to set up your business because you want to make sure that they get back their money. Even though they may not want it back, you want to be able to stand on your own two feet and say that you succeeded. So you pay back all the money that people invested in you so that you can then go forward with your business or your enterprise to clear your debt.

personal finance English collocations

And clearing your debt means

to pay back the loan

So every loan that we get, whether it’s the overdraft for less than 12 months, it’s the medium-term loan to buy machinery for three years or it’s the mortgage for 10, 15 or 20 years.

At some stage, we have to give the money back to the bank. And that means to pay back the loan.

So when you pay back a loan, you return together with whatever interest of course that they are going to charge you over that period of time. So pay back the loan.

If you’re really, really lucky, the bank might agree

to write off the debt

or to write off some of the debt.

So if you tell the bank that you’re in some financial difficulties, and you cannot, under any circumstances, pay back the money you’ve borrowed, they may after a lot of arguments and discussion agree to write off or to write off some of the debt.

It means that they will cancel it. They will say okay, you no longer owe us 10,000 euro, we’ll settle for 3,000 or 4,000 euro and then your debt is written off.

It doesn’t happen very often and usually, you have to be in a very serious situation like bankruptcy. When you are bankrupt under the laws of bankruptcy depending on which country you live in, the debt that you owe to people, whether it’s a bank or an individual, will be written off when you are declared bankrupt.

All of the debt up to that date is written off because it’s absolutely certain that you’re not in a position to repay the debt. So to write off the debt.

Or somebody might just be a very generous person. And they tell you, they don’t want the money back. That usually is some small loan.

You know, with my kids, when they used to borrow money when they were teenagers, ‘I repay you, Dad.’ So what do you do? You write off that debt, because you know, in your heart and soul, that you’re never going to see that money again. So you write it off.

So they’re some of the collocations are many, many more, we’ll cover those again, in another podcast episode.

Some here are some of the personal finance English collocations. I hope you’ve enjoyed them, I hope you understand them.

If you don’t already have some issue, or you want to ask me something, by all means, please contact me. I’ll be very happy to help you.

And as always, if you want to contact me, you can do so at www.englishlessonviaskype.com.

Okay, as always, I really appreciate you. Thanks a lot and join me again very, very soon.

More information

For more information on English grammar rules, English collocations and English idioms, check out the links below:

Phrasal verbs related to driving

10 Ways to say STRANGE in English

You can always study English advanced level at learning English with the BBC.

You will love these English lessons

English Phrasal Verbs with LOOK

Phrasal verbs with look. Learn English vocabulary. Online English lessons on Zoom and Skype.

16 Ways To Say Goodbye In English

Learn 16 ways to say ‘goodbye’ in English. Do you want to be more fluent in English? Start using other

Other Words for LIKE in English

Other words for LIKE and why you need to use them. Avoid using the same words over and over again.